Describe How a Traditional Savings Account Works

Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing. Ad Use Our Savings Calculator and Apply for a Citi Account.

Lets take a look at each of these common places to stash your cash.

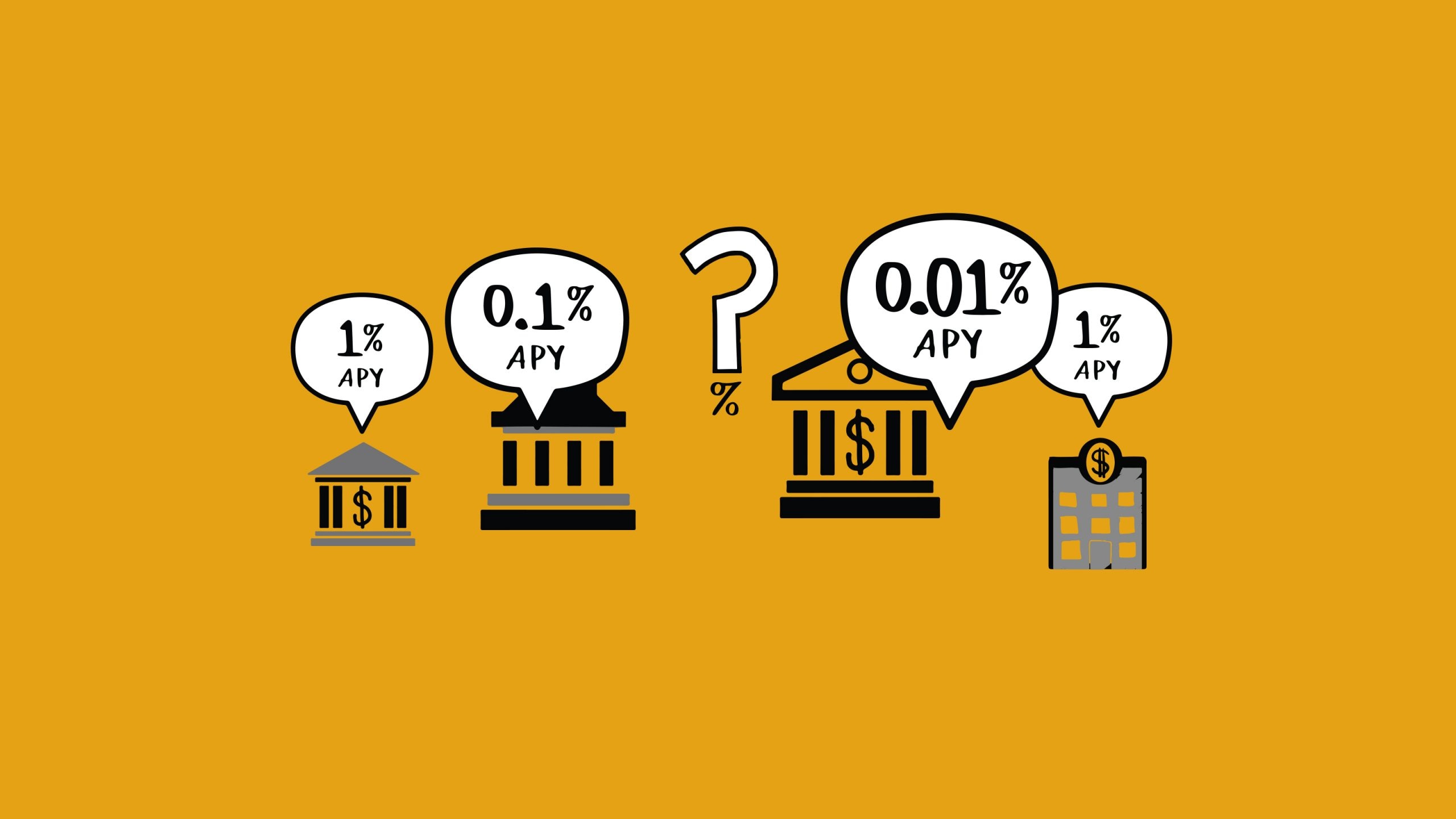

. All You Need is the Best Rate from Bankrate. Savings account interest usually compounds daily. Online savings accounts usually have higher APYs than traditional banks ranging from15 to even 2.

Traditional savings accounts typically have low interest rates and annual percentage yields APYs especially when compared to high-interest or high-yield accounts. A savings account is a type of account that allows you to deposit money youre not planning on using anytime soon while earning interest on your balance over time. The bank lends your money out to other people and.

You put money in a bank. Ad Financial Wellness is Closer Than You Think. Sounds simple enough right.

Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need. A typical basic savings account lets you withdraw your money whenever you want. The bank then pays you interest on your balance.

You earn interest because youre lending. No Account Minimum or Limits on What You Can Earn with a Citi Accelerate Savings Account. Its an account you typically open along with a checking account but one that you dont want to spend from on a.

Make money on money thats just sitting around -- thats the basic premise of a savings account. A savings account is a bank-offered service which allows you to store your money while earning interest on your deposits. A traditional savings account is federally regulated via Regulation D which mandates certain types of telephone and electronic withdrawals including transfers from.

Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Do Your Investments Align with Your Goals. Money Market accounts usually pay more money in interest but will typically require you.

How Does a Savings Account Actually Work. The bank then pays you interest on. A savings account is a deposit account thats designed to hold money you dont need or plan to.

You open a savings account at a bank or credit union and deposit money into the account. Like the name implies savings accounts are designed to help you save. A traditional saving account is a default savings account that is offered by a instore bank- like you have to go through the bank these usually do not come with checks.

With the power of compounding interest your balance would grow a lot. Find a Dedicated Financial Advisor Now. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing.

Official Site - Open A Merrill Edge Self-Directed Investing Account Today. A savings account is a deposit account held at a financial institution that provides principal security and a modest interest rate. Primarily they do this.

Roll Over Into A TIAA Traditional IRA Get A Clearer View of Your Financial Picture. Traditional Savings Account Describe how it works Draw a picture. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

On the first day you only earn interest on your initial. So your daily interest rate would be your APY divided by 365. Type of Saving Account.

A traditional savings account is fundamentally a place to hold your money.

7 Questions To Ask Before Opening A Savings Account Forbes Advisor

Pros And Cons Of Savings Accounts Ally

No comments for "Describe How a Traditional Savings Account Works"

Post a Comment